Snap: A Pictaboo into the Past, Present, and Future of Social Media

The Camera company that has the best view in social media's development.

Snap: A Pictaboo into the Past, Present, and Future of Social Media

Welcome to Think With ABD’s inaugural Substack publication! 👋 Consistent with ABD’s vision, we’re here to explore stories and people behind the developments of technology, analytics, digital, and design. For our first edition, we explore Snap Inc.’s tumultuous run over the past decade, how it innovated and focused on community to bounce back, and what does it say about social media’s growth and future.

Snap is one of the few – if not the only – social media company that brushed with death, only to comeback. Building on its eponymous Snapchat app, it has become a multi-app platform leveraging camera, AR/VR, its own Map app, and much more, to become a thriving community for both users and advertisers. Today, there are ~280Mn daily active users (DAU) on Snap’s platform creating 5Bn Snaps everyday. Snap is one of the largest social media companies, valued at $100Bn.

What’s coming up:

Ghostface Chillah: Snap’s Beginnings and Rise

How Could You Kylie: How a Single Tweet Erased $1.3Bn

Innovation is Not Enough: Snap Regains its Footing

20/20 Vision: Videos, AR, and Social Media’s Future

1. Ghostface Chillah: Snap’s Beginnings and Rise

Snapchat started under the name Pictaboo in 2011. It was started by Reggie Brown who first pitched the disappearing concept to Evan Spiegel. Spiegel then brought in Bobby Murphy to code the app. Brown designed Snapchat’s logo, named Ghostface Chillah, inspired from the hip-hop group Wu-Tang Clan.

When Snapchat first began, it had one thing that other social media sites didn’t have: the photos and messages sent on the app vanish after 24 hours. Around the time when the current social media kings, Facebook and Twitter, function as social diaries as well while also seeing more parents and older generations join, Snapchat’s approach voided this and appealed to younger generations.

More importantly, Snapchat, unlike Facebook (founded 2004) or Twitter (2006) who started in desktops, was born in the mobile era, and with that the ubiquitous camera. Snap has always prided itself as a “camera” company, and not a social network or social media company. It believes that reinventing the camera represents it greatest opportunity to improve the way people live and communicate. Indeed, chief among Snapchat’s greatest strengths is that it’s primarily an Image-first platform, and Image-based content command the highest engagement in social media.

Source: Sprout Social

By December 2012, Snapchatters were sending 50Mn snaps per day or 63 Snaps per second. But, as with any rising star, Snapchat was just getting started. Snapchat launched its category-defining Stories product in October 2013. Stories allowed users and advertisers to share fun photos with everyone while still boasting Snap’s temporal feature. In 2014 a Chat function was added and it’s the combination of Stories and Chat that made Snapchat lean further into social.

2015 was another hallmark year for Snap’s innovation machine. Snapchat introduced Discover in early 2015, a new page easily seen from the home screen that featured short-form ad content from a range of publishers and channels. More importantly, Snap launched Lenses. By then, Selfies were embedded in the mobile culture. Snap, and one of its eternal rivals, Instagram (owned by Facebook), arguably facilitated the Selfie movement, which had its own song. Yet, Snap one-upped Instagram and peers through Lenses. In a way, Lenses could be considered as one of the first applications of Augmented Reality, which we’ll get into more later.

Not only was Snapchat more fun for users, it was also proving to be more and more lucrative for advertisers.

At this point, we could then visualize Snapchat’s model into:

Thesis: Cameras are a superior way for self-expression and communication, and our mobile phones are among the best cameras -> Innovate: Develop cool camera products to get users to the app -> Users then engage -> Advertisers would value your product and audience -> Profit, then reinvest into your thesis and innovate. Rinse and repeat.

Snap was riding high in 2016. In April, Bloomberg reported that Ghostface Chillah’s spawn was generating 10Bn video views per day, 2Bn more daily views than Facebook. By June, Snapchat has amassed 150Mn DAUs, surpassing Twitter. Snap started its foray into hardware with the introduction of Spectacles, sunglasses with an integrated video camera that makes it easy to create Memories and integrates well with the Snapchat app. In addition to its product factory, Snap also acquired Bitstrips maker Bitmoji for ~$100Mn. Spiegel even got engaged to Victoria Secret Angel, Miranda Kerr, who used a custom Snapchat filter that uses Bitmoji (though, ominously, the photo was posted on Instagram). To cap it off, Snap filed in late 2016 to go public in early 2017, with the Wall Street Journal reporting that it could be valued at upwards of $25Bn.

2. How Could You Kylie: How a Tweet Erased $1.3Bn

Life was good for Snap and Spiegel. It raised over $3Bn at its May 2017 IPO and it rallied to ~$33Bn at the end of its first week as a public co. It was the next Facebook.

Prior to being public, Snap was courted by the likes of Google and Facebook several times in the past. Yet, Spiegel and Co. decided it was strong enough to forge alone. Before long, celebrities and influencers populated the platform, who were then followed by publishers and advertisers. Snap was cool.

Yet, Snap proved to be vulnerable to the omnipresent forces of competition and ever-changing consumer tastes.

Facebook decided that if it couldn’t join with Snap it would fight it instead. As for Snap, imitation is the greatest form of flattery, until it hurts. In mid-2016 through 2017, Facebook launched Stories for both its core Facebook Blue app and its Instagram platform. Indeed, Snap growth slowed by 82% after Instagram stories launched, and by mi-2017 Instagram has surpassed Snapchat.

What’s more, consumers are fickle, and product rollouts aren’t always successful. In late-2017, Snap announced a redesign that was so controversial that over 1 million people signed a petition to remove the update. The new layout was more cluttered and made it harder to find a specific friend.

The coup de grace it seems came, ironically, in the form of a tweet. In a late February afternoon, Kylie Jenner tweeted she was no longer as active on the app and implied it was a ghost town. Snap stock lost $1.3Bn in value that day.

By June 2018, Snap’s stock has lost roughly half of its value when it sunk to $13 per share. It closed 2018 just shy of $6 per share. Ouch!

3. Innovation is Not Enough: Snap Regains its Footing

As alluded to earlier, the social media industry face a winner take most risk, with losers settling for scraps or shutting down. Snap went from the breakout winner of the mobile generation to an almost undeniable loser in a span of roughly two years.

Every social media company can be seen as having to deal with four external stakeholders: Users, Advertisers, Competitors, and Regulators. We’ll ignore Regulators for now given Snap’s size and its proactive stance towards privacy. That aside, Snap was having trouble with the other three.

For users, Snap used to be fun, cool, and hip, a place where you could be as kooky as you can with your friends using Snap’s cool products. However, Snap was trying much harder to appeal to Advertisers, who ultimately pay for all these products and Snap’s ambitions. Further, competitive pressures just piled on top of Snap’s mis-executions.

So how did Snap recover? Well, it took a beating from the start of 2018 through early 2019. Snap, however, kept on innovating, tinkering and adding neat products throughout that time. But, we posit that the turning point started with the hiring of two new executives. Particularly, Snap hired Jeremi Gorman former Head of Advertising Sales for Amazon. It remained a team effort, make no mistake. A proper social media app should appeal to both advertisers and users for it to be successful.

Most importantly, Snap, instead of trying appeal to all users, renewed its focus on its core Gen-Z/younger millennial demographic. But, how did this manifest in its products and features? Well, two things: first, more products; and, second, let others copy your products. Ultimately these two moves are part of a broader evolution, but we’ll get to that later.

More Products

The fastest way to grow users in the mobile era is to go international. Snap was predominantly a North America/Western Europe focused company but for it to move some growth and profitability in its app it needed to replenish its user base. While a bit delayed, an improved Android app was introduced to fast-growing markets such as Asia-Pacific and LATAM. Also, make everything better.

This image from Snap’s 2020 Investor Day exhibits just how much Snap continued to invest in its products throughout its tumultuous period.

a. Bet on AR and continue innovating

Snap imagines the AR future beyond the phone and its Spectacles product is its investment in this future dated from 2016. Snap sees that over time, the same lenses we use on smartphones today - lenses that allow users to shop new outfits or see our characters of choice come to life - would be experienced in full immersive 3D.

Snap's team is focused on forwarding AR-based advertising, first through shaping AR as a utility (i.e many of SNAP features leverage AR), and then making it easy for brands to create and experiment on Snap's AR platform. One of our favorites is Snap’s Gucci Lens, which allows you to try on some shoes using your camera, and the Maps, which lets us discover interesting places close by:

Snap also ramped-up its Gaming and Utility offerings via Minis ( bite-size utilities made for Snap users). Minis are a new platform for social experiences such as buying move tickets and even registering for votes.

b. Let Others Copy Your Products

Snap flipped Facebook’s script on its head when it decided to open up all of its products to everyone willing to partner instead of waiting for the next look-alike. Why allow others copy Stories, Lenses, Bitmoji, and others, when you could just lend and integrate it to others, thereby allowing you to retain IP ownership and control.

To further facilitate and encourage Lens Studio usage, Snap rolled out Creator profile which are: “dedicated spaces for Lens creators to showcase their work and connect with their audience.” Creators can now incorporate hand movements, body movements and even their pets in an expanded Lens creation toolkit.

Okay, what do all these things mean?

Despite Snap’s continuous innovation streak, to this day we still get new Stories copy-cats. But that’s fine. The twin moves of building more products and functionalities and opening up your platform are part of a broader trend, one that’s still developing at lightning speed to this day: Creating a Community. Definitions could be fuzzy at times, but we argue that Snap’s Platform of products and Users and Advertisers is merely the setting for its Community, which largely includes Creators, who are also Users or Advertisers! The opening up of its platforms extends that mindset to allowing other companies to use its own products to interact with other members of the Snap ecosystem. Each share function makes Snap slightly more utilitarian than simple entertainment.

Snap understands that every advertiser is a performance advertiser, be it brand or direct response. It sees that the best advertising offerings appeal to the CFO as much as it does to the CMO; in short, an essential investment in the future of a business.

At this point, Snap’s model looks different:

Thesis: Cameras are a superior way for self-expression and communication, and our mobile phones are among the best cameras -> Innovate: Develop cool camera products to get users to the app and open your products to other Brands and Companies to Build on -> Users, Brands, and Partners engage and create communities and you improve your products -> Advertisers would value your product and audience -> Profit, then reinvest into your thesis and innovate. Rinse and repeat, only this time your Community constantly helps you improve your products and build new ones.

Snap comprises only 2% of the US digital ad market, but this is at odds with how it reaches half of US smartphone users, most of which fall under the highly attractive and growing generation aged from 18 to 35 year. To this, Spiegel said Snap can deliver 50% annual revenue growth over several years.

4. 20/20 Vision: AR, Creators, and Social Media’s Future

It’s July 23, 2021, and Snap’s stock soared roughly 25% on the back of its Q2 2021 earnings call. Snap is now a $100B company, one of the largest internet and social media companies on the planet. Snap’s latest quarter saw its highest revenue run rate at $983M, and growth is only poised to accelerate from here. Some things have not changed though, such as the fickleness of users, Spiegel’s vision for the camera, and that execution and partnership are paramount in realizing that vision against users’ whims. For that, Snap’s journey into the 20s is only beginning. In fact, its journey as a company is only starting.

It can turn us into Disney characters. It can guide us through Disneyland and make it even more magical. Its Map would even start recommending cool places nearby to check out. What’s more, if you think trying on Gucci shoes through its app was fun, well the shopping experience on Snap has just gone onto a new level after some astute acquisitions.

But, as exciting all these prospects are for Snapchat, it is far from alone in having these aspirations. Discover and Spotlight are rivalled by Facebook and TikTok’s algorithms to lure users into watching and producing content. Facebook continues to invest in Oculus, in hopes to win the AR frontier. Google’s Youtube and TikTok are empowering creators to improve their craft and grow their audience. Almost everyone is investing heavily in building out their apps’ commerce competencies. And, of course, Community: Twitter, Facebook, Pinterest, Youtube, TikTok, and even video game companies like Fortnite, Robolox, and Minecraft, pride themselves on the robustness of their Community.

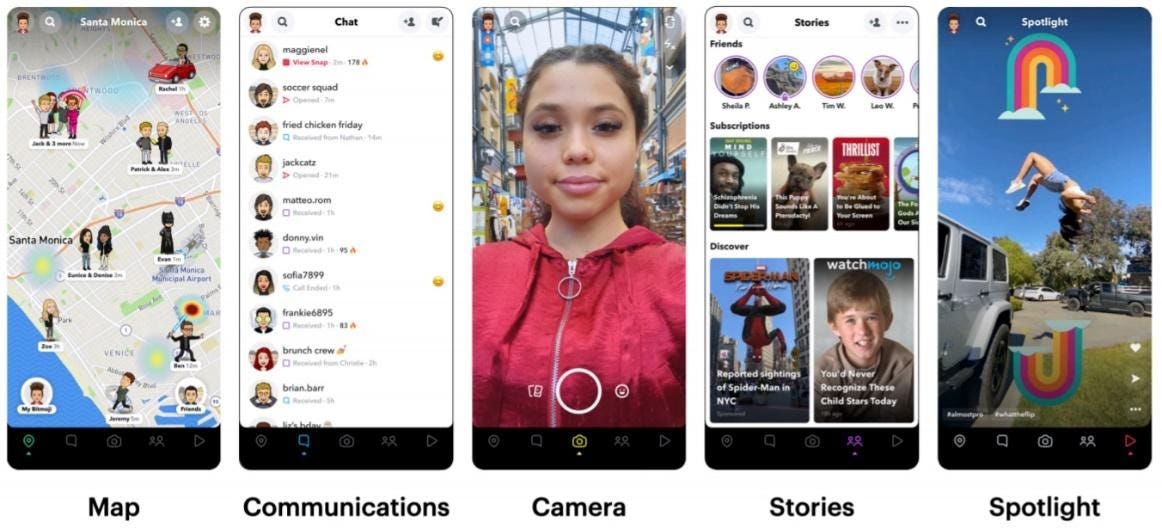

And Snapchat? Well, Snapchat’s proving to be a dark horse in the social media race. It opens with a Camera but it’s also part Map, part Messenger, part AR tool, part Shopping destination, part Creator tool, part Gaming app, among other utilities.

And here lies the crux of it: as we enter the 20s, social media companies are no longer just social media companies where you keep in touch with your friends. These platforms now extend across different aspects of our lives, from connecting to creating content for strangers and even buying directly from local merchants. Oddly enough, a lot of these are image or video based, which primarily depend on your smartphone. Guess Snapchat was onto something when it said it was a Camera company?

We hope you enjoyed our first edition of Think With ABD’s Substack! You can check out our other contents on our website and podcasts.